Time is running out to take advantage of a simple tax deduction for 2022! Section 179 of the IRS tax code allows businesses to deduct the FULL PURCHASE PRICE of qualifying equipment and software purchased or financed during the 2022 tax year. However, in order to qualify for the deduction, equipment must be purchased and in service by December 31, 2022, so don’t wait!

As one of the few incentives available to small businesses, millions are already taking advantage and benefiting from Section 179 deductions. For 2022, the cap on the total amount that can be written off was raised to $1,080,000. While targeted towards small businesses, all businesses that purchase, finance, or lease new or used equipment during 2022 qualify for the Section 179 Deduction.

For more information, please visit section179.org.

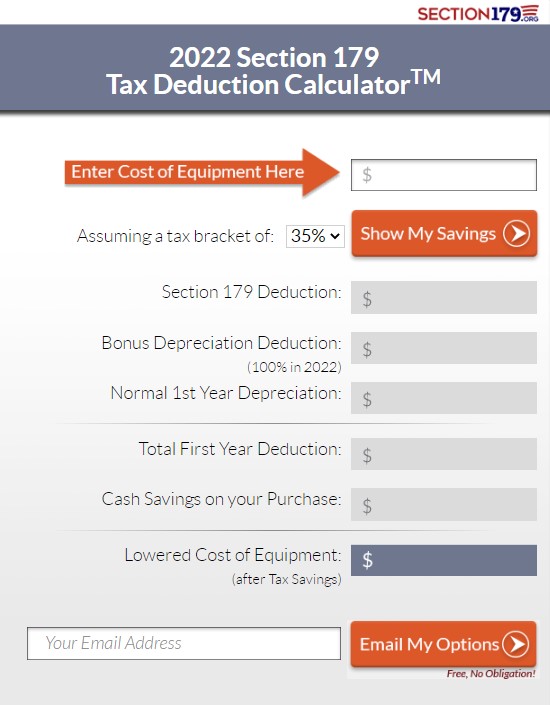

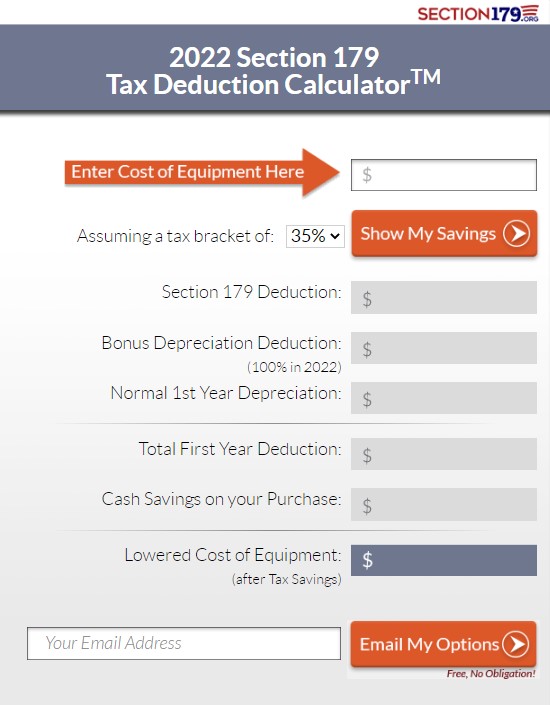

Section 179 Calculator

Still considering your next steps? The Section 179 tax calculator is a great place to start to see just how much your company could be saving. Simply open the calculator, enter your cost of equipment and see how much you could be saving before 2022 closes!